According to an article I saw on NerdWallet, a website devoted to personal finance decisions, people would rather talk about topics like death, religion, sex, or politics – instead of money.

The problem is, most of us are so uncomfortable talking about money, we rarely get around to doing it. And there are real costs to not having conversations with our kids about money. For example, why would we allow teenagers to take on tremendous amounts of student loan debt without talking to them about what they might reasonably expect to earn after graduation and what it really costs to run a household?

Or, how many of us explain to our kids that credit cards are not free money, when it looks an awful lot like that to children (and yes, to some adults as well). Our children definitely absorb the way we talk – or don’t talk – about money. What messages are they absorbing?

I know it’s hard to have these conversations. Part of this is because we often use money as a yardstick to measure our own success. If we come up short against what we perceive our friends and co-workers have, does that mean we are unsuccessful?

Or what if you have a greater financial success? This can bring up conversations around opportunity and inequality that we can be deeply uncomfortable addressing. Let’s not kid ourselves (pun intended) – our children will get a pretty good idea of where we stack up in the world as they progress through school. Avoiding money talk won’t prevent them from making assumptions about family finances.

Conversations about money are critical to our kids’ success once they enter the real world, and they are also critical to instilling our values in our children. So how do we start opening these conversations with our children? Frankly, children are naturally curious, so they may already be asking you questions, such as: Why is our house smaller (or larger) than my friend’s house? or How much money do you make?

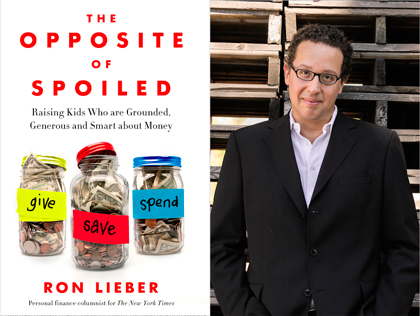

My favorite suggestion comes from New York Times columnist Ron Leiber, the author of The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money. Lieber suggests four (brilliant) words to respond to our children’s money questions: Why do you ask?

My favorite suggestion comes from New York Times columnist Ron Leiber, the author of The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money. Lieber suggests four (brilliant) words to respond to our children’s money questions: Why do you ask?

In truth, this little question can be used successfully with a large number of big questions about potentially awkward topics. Personally, I’ve used it to clarify questions about money and sex, so it really is very useful! “Why do you ask?” is a beautiful response, first, because often the question we think kids are asking is not actually what they are asking. By clarifying, we can make sure we are answering the intended question.

Second, and perhaps more profoundly, responding with a friendly “Why do you ask?” lets your child know it is okay to ask you questions – especially tough questions they may not be able to ask anyone else. And really, open communication between you and your child is truly precious.

Third, responding to their question with a question buys you some valuable time to get your wits about you. As you might imagine, simply deciding to start having conversations about money in an open way does not suddenly undo all the societal taboos around talking about money. Pausing for a moment to figure out what you want to say is a good idea.

How much information should you share about your finances with your kids? Is there such a thing as too much honesty? While there are no hard and fast rules, a lot of it depends on the child’s age. Don’t feel like you have to tell your children how much you make just because they asked. A response like, “I make enough to buy the things we need and a little extra to save for the future” is perfectly appropriate.

Older children can understand more complex topics such as investing, college planning, and how interest is charged on a credit card balance or a loan. Younger children can start to understand basic budgeting, why we save for the long term, and the virtue of delayed gratification. Helping children work through spending their birthday money is a good example. Don’t automatically give your child extra money if he wants to purchase an item that costs more than what he has on-hand. Let him struggle with the decision.

Looking at the big picture, it’s one thing to be open about money with your kids; it’s another to burden them with your family’s financial challenges. I’m not suggesting you pretend everything is fine if one parent loses a job, has to take a second job, or is disabled for a period of time, but it’s not appropriate for parents to vent all of their financial worries to their children. Children have no control over the situation and no way to help resolve it.

When talking with kids, don’t be afraid to share stories about your financial missteps and what you did to recover, or how your family persevered during a financial setback. Family stories like these can help children build resilience.

At an early age, make sure your kids understand there are families who are in better shape financially than yours and families who struggle mightily to put food on the table. Children need to learn empathy and compassion at home, especially around the topic of money. Nurture your connection to your children by being willing to talk about tough subjects such as money. By using the ideas in this article, you can keep the lines of communication open and teach kids healthy financial habits.